Year End Report 2013

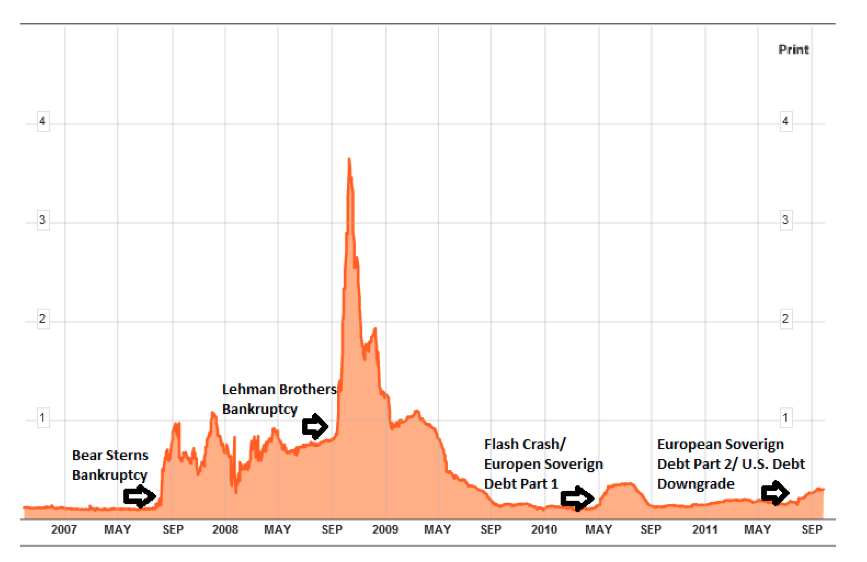

Was it really just five years ago, when the market collapsed and took the whole world on a scary path toward another Depression? How can it be, the market went down 60% in 2008-2009, then reversed course, and in a five-year period, went up 175%? Did earnings really change that much? What causes this type of crazy behavior? What will our grandkids say about the mess we went through?

As always, we will try to give you the answers below.

Hindsight confirms buying or holding stocks at the end of 2008 was the single best thing you could have done to make money. We also know, it wasn’t easy to do. We went home after the flash- crash, (2010) and the European crisis, (2011) and wondered whether the financial world would ever return to normal. Many investors did sell out and missed the return to new highs in the S&P 500. Congratulations--you survived and recovered.

We think the fair value of the market today is 1650, based on the S&P’s earnings’ average over the past five years. As I write this report, the market is at 1825. For the first time since 2007, under our system, the market is actually overvalued by 10%. Stock prices have outpaced the growth of earnings, which won’t go on forever. We project, in a few years, when earnings rise and we’re rid of 2009’s bad earnings, a fair target for the S&P 500 is 2150. But how should we deal with this scenario where we are overvalued today, and undervalued three years out?

Veritably all the world’s central bankers are printing money to jump-start their economies. A money flood might be more accurate. The U.S. economy’s Gross Domestic Product (GDP) is around $16 trillion. With luck, our economy in 2013 will grow by 3%--inflation included. If the Federal Reserve wanted to increase our banks’ liquidity to help them deal with 3% growth in the GDP, the absolute maximum amount of money needed is $480 billion ($16 trillion of GDP x 3% growth).

In 2013, our Federal Reserve printed one trillion dollars--twice that amount. Where did that extra $520 billion go? A lot went into the stock market, which is a major reason your account performed so well. The Federal Reserve is creating a bubble in stocks by printing more money than the real economy requires. Because the excess finds its way into the stock market, we call it happy inflation, and why we predicted a big bull market for 2013.

Said another way, U.S. banks have $9 trillion in deposits and have lent $7 trillion, leaving $2 trillion to be accounted for. Until the world’s central bankers start to pull the excess from the system, the wind is at the stock market’s back.

We do think a change is coming within the next eighteen months. When the global central banks print currency, it first goes into Treasuries, then high-quality corporates, followed by low quality corporates, stocks, then commodities. In our opinion, the next area for growth is commodities, and our asset favorites are gold and oil.

The last quarter of 2013, we bought Exxon, Royal Dutch, and Royal gold. Now starting 2014, we will sell some stocks in our taxable accounts and buy more Royal Gold. We waited until January to prevent creating a taxable transaction in those accounts by selling a stock two days before 2013 ended.

Besides the normal process of money flowing to commodities late in an economic cycle, two catalysts could speed up a bull market in oil and gold. One is the Middle-East. The other is Europe.

In respect to oil, we see a real problem with our country’s relationship with Saudi Arabia. For forty years, the quid-pro-quo arrangement has been the U.S. protecting Saudi Arabia militarily, and Saudi Arabia accepting our dollars in exchange for the oil it produces. In 2013, the U.S. reneged, when it didn’t protect Saudi interests in Iran and Syria.

It isn’t my job to determine what’s right for President Obama to do in the Middle-East. It is my job to interpret U.S. policy changes and capitalize on them. By walking away from Saudi Arabia, President Obama opened the window to something we may not like economically. We think there is a thirty-percent chance Saudi Arabia will start pricing its oil in currency other than U.S. dollars.

If that happens, the price of oil in the U.S. will increase. Our currency would decline, due to less demand for dollars to buy oil, and it would cause all commodities to go up. The CRB Index (a basket of commodities) was around 450 in 2008. It is now at 280. We think there is a good chance its correction is over, as well. Buying Exxon/Royal Dutch is a great way to protect your account.

Gold is a big asset beneficiary, if Saudi Arabia changes its oil pricing. Most of us remember how much gold values increased during the oil embargos in 1973 through 1981. What pushed us to buy gold this quarter was another event during the last week of December: The euro member-countries’ economic summit was a miserable failure.

The euro crisis has been on the back burner for two-and-a-half years. We think Euro Angst will return in 2014. For the euro to be a stable currency, Germany must share its money with the rest of the European Union. In return, the other euro countries must accept economic oversight, dictated basically by Germany. During those two-and-a-half years, we have heard the member-countries will comply. A week ago, they refused.

We think this failure means money will leave the euro and head elsewhere. As a result, the European Central Bank (ECB) will have to print more. (At the end of this report, a chart shows the relationship between gold and the ECB balance sheet.)

Some of the money will find its way to the U.S., and benefit our dollar (assuming Saudi Arabia doesn’t pull the plug). We think a good chunk will go into gold, which is why we bought Royal Gold the first week of 2014. Because Royal Gold is down 60% from its highs two years ago, it qualifies under our system. When a stock declines 60% and we buy it, we aren’t under any illusions it won’t go lower. We have followed this stock for nine months, and the mess in Euro Land initiated buying it this quarter.

Our move into oil and gold stocks is what Wall Street quants (quantitative analysts) call non- correlated investing. In laymen’s terms, if you own a basket of stocks, like we do, and they decline, gold and oil stocks usually will go the opposite direction. Hence, they are non-correlated.

Last quarter, 2013, Exxon was up 16%. Royal Gold was down 7%. The S&P 500 was up 10%. Royal Gold was doing its job--going the opposite way of the general market. Exxon was not. What probably didn’t hurt, and likely helped Exxon’s performance, was after we bought the stock, Warren Buffett bought a $4 billion position in it.

For three years, gold and oil stocks have been poor performers, compared to the rest of the stocks in the S&P 500. We think that will change over the next eighteen months, and it’s better bet to own these stocks, than to have cash. In essence, we are starting to hedge your portfolio’s gains by not owning what traditionally goes up, when the S&P 500 goes up.

We can anticipate your next question: Why not sell everything and go to cash? The answer is, we still believe the valuations of what we own are still good, while the overall market’s valuation is ahead of itself. As long as the world’s central bankers are flooding us with money, the value of stuff will do better than cash. We anticipate this trend continuing. Hence, we are buying more stocks that sell stuff.

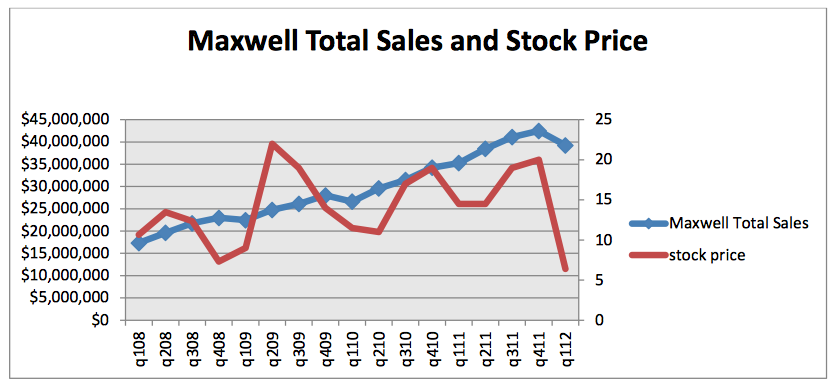

As is our tradition in these year-end reports, we’ll ignore what worked out in 2013, and focus on problems stocks. We owned three at the end of 2013’s first quarter. Now there is just one: Maxwell Technologies. This stock will be problematic throughout 2014, and here’s why: At the beginning of 2013, Maxwell caught some salesmen cheating on how they reported sales. The cheating caused Maxwell to restate its earnings. We felt comfortable this was a painful non-event, and it was.

The bigger problem is China. Maxwell sells ultracaps (ultracapacitors) to improve the performance of electric cars, trains, busses, windmills--anything needing sudden jolts of electricity. In the last five years, average sales have gained around 25% per year. This is outstanding. A lot of that growth came from sales to Chinese bus manufacturers, (diesel and electric) who received a subsidy from the Chinese government to sell busses that reduce pollution.

The Chinese government has no exposure in ultracaps and wants into the business. It has made prior overtures to Maxwell for a joint venture, in terms reminiscent of a Mafia shakedown: Make an offer they can’t refuse. Except Maxwell has.

China pulled the subsidies Chinese diesel bus manufacturers received to use ultracaps. The government did not curtail the electric bus-makers’ subsidy. It all goes to Chinese-owned companies, who profit from battery or diesel sales, but not from the ultracap sales. China wants the technology Maxwell won’t give up. Government hardball is freezing out about 30% of Maxwell’s current sales.

We figured out this stalemate in quarter four, when Maxwell’s stock was around 7-1/2 bucks-- where it basically is trading now. We are assuming the bus subsidies’ issue will hang over this stock through 2014, until Maxwell’s sales increase in other areas and offset the loss of these orders.

Maxwell has signed a new contract with a Korean company to start the process, but it won’t happen quickly enough to help our earnings for the first part of 2014. At some point, we think China will give in, but not until the government is convinced it can’t inflict any more pain on Maxwell.

The enterprise value of Maxwell is only $200 million. If the stock stays down at these levels, we think there is a decent chance somebody will look past the China problems and offer a buy-out at prices higher than these. We have decided to sit through inevitable bad earnings coming in 2014, (in 2013, it had record earnings) and bet Maxwell is either bought out or grows its way out. Meanwhile, we will continue providing updates on Maxwell.

We view 2014 as a consolidation year for the stock market, as a whole. You can’t earn 30% per year, every year. (I wish you could, but you can’t.) We’re confident what we own is fairly valued, and will beat owning bonds or cash. As we explained earlier, if the market consolidates its gains, we think certain underperforming sectors, like commodities, will improve.

The Fed is now printing only $75 billion a month, rather than $85 billion a month. This is still a huge wind at our backs, and could cause our consolidation year prediction to be a mistake--to the upside. We continue looking for stocks we think will make 9% to 10% a year. These days, there are fewer stocks to choose from, but we are considering new ones popping up to buy next quarter.

As always, feel free to call us with any financial questions you have.

Sincerely,

Mark Brueggemann IAR Kelly Smith IAR Brandon Robinson IAR