Third Quarter Report 2011

Greece is bankrupt, the U.S. government almost defaulted on its debt, commodity prices made a new high before they tanked, World stock markets collapse, European banks stocks drop 50%, Brazil starts a currency fight with China, U.S. consumer confidence drop as much as it did after 9-11 and the Chiefs and Rams are 0 and 6. As you can guess from the headlines it wasn’t a fun quarter. The stock market is at another cross road similar to last year at this time. We think the most logical resolution of this intersection is for the markets to go up like they did in 2010. This was not a good quarter for the PRICE of our investments but we don’t think now is a time to shy away from owning stocks. We will outline below why we feel this way.

I guess we are going to have a debacle a year now in the stock market and the third quarter of this year was similar to last year’s second quarter. The markets were a mess then and they are right now. We have included some charts in the back of this report to show you how ugly it got out there. As we have stated in previous letters we have worked on a macro system since 2008 to tell us when to lighten up on stocks and favor bonds or other asset classes. It’s a fairly complicated system but in its most basic sense it boils down to this, if there is credit available in the world for business the world economy and their stock markets will do ok and when there isn’t it won’t. Though the stock market decline has raised the cost of capital for some firms since July 15th there is still plenty of credit available in the world to fuel a stronger economy than most investors think is going to occur. Hence, we are long stocks and not bonds or other alternative investments. In back testing our system from 1970 to today there were three periods where our monetary system was this positive and the U.S. stock market tanked. Those three dates were the crash of 1987 (the market dropped 50% in 8 weeks), the flash crash of last year (we lost 17% in 4 weeks) and this year’s crash (we lost 20% in 6 weeks). In the first two examples the market actually finished up for the year whereas this year the markets are still down over 10% as I write this. We hate having bad quarters and this one stunk. You lose money (and so do we), we make less in management fees and generally the mood around the office is not good. We have tried to figure out a way to trade these swings where we “speed” up the turnover in your accounts to take advantage of these 15% moves. To date we don’t have anything we would like to show you though we continue to work on that idea. We feel it is better today financially to take a long-term view of “the economic cycle” which means less trading but more exposure to messes like what we have been through the last two years. We continue to think that the amount of money printed in the world will drive prices of ALL asset classes higher. Why didn’t it happen this quarter?

Europe is a mess and it’s become the world’s problem. Let me explain why the stock market is acting like it is based on Europe’s woes and the worlds experience in 2008. When Lehman Brothers collapsed in 2008 it started a bank run that was the worst thing I have ever seen. Investors always remember the last war they fought and when it became obvious in August (we wrote about it in June in our last letter) that Greece was going to default, maybe investors remembered what they should have done in 08 during the Lehman bankruptcy and started selling. They sold gold, oil, soybeans, emerging markets, pork bellies etc and bought the government debt of countries they view as safe. The preferred way to get safe was to buy U.S., German or Japanese bonds with yields of 2% or less. In our opinion this is crazy when you have U.S. inflation over 3% but it’s not crazy to investors who lost money in 2008. The obvious question that should be asked of us is “Why didn’t we sell if we predicted in June that Greece would go broke?”. The answer is we don’t think this move is going to be the start of another 2008 debacle where the market drops 60%. If we are wrong we will be guilty of predicting a flood and not building an ark which is not a good thing. That’s not something we think we are doing but let us elaborate on that next.

If the markets fear is that there is a run on collateral like 2008 then ground zero for collateral runs is the banks. If there is a panic it will be felt there the worst. So far this quarter all bank stocks have been hit hard and particularly European bank stocks. The question we ask ourselves daily is “Prove its different this time and that this European crisis won’t end up like another 2008”.

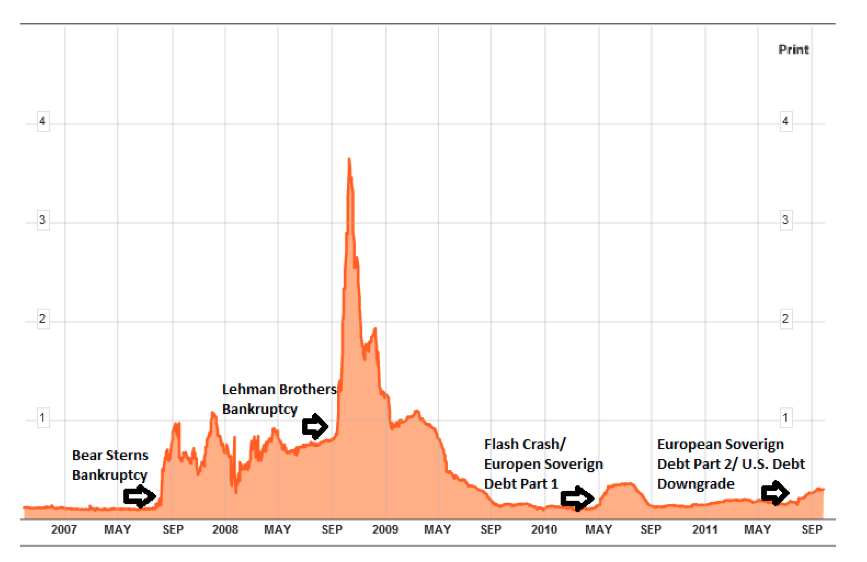

The graph above is one of our bank warning signals that help us decide when the U.S. is having SEVERE bank funding problems. We developed this system after 2008 to help us judge how bad it is out there. When the bottom line spikes up there is a problem with banks in this country and more than likely there is a lot of fear in the stock market. As you can see from the chart most of the time nothing is happening and that is the case right now. There is no fear in our banking system compared to 2007 and 2008. It’s just not there. The stocks of the banks are tanking like its 2008 but the actual funding of U.S. banks is actually very, very, strong. I will give you a case in point; there was a Wall Street journal article about 6 weeks ago where a foreign investor wanted to put 500 million into one of our U.S. banks. The bank said we don’t want your money because we don’t have anywhere to lend it. The investor said I WILL PAY YOU 15 basis points (that’s just over one tenth of one percent in interest expense) to hold the money and the bank said OK. Now think about that for a minute, a foreign investor is willing to pay somebody to hold his money ($750,000 a year) in the U.S. rather than hold it in the country he is living in. He would rather PAY a U.S. bank to hold his money than receive interest in the country he lives in. This obviously shows this investor is very afraid of the banks in his country but he is not afraid of the banks in the United States. It is our guess it’s a European investor who doesn’t know what’s going to happen to Europe and the Euro so he is stashing his money in the U.S. until that situation gets cleared up. We have another banking fear index that tells us how scared they are in Europe.

As you can see from the chart there is some fear creeping into their bank market but it’s not even close to what it was like in 2008. So to sum this up, we have the fear of 2008 but we don’t have the actual run on the U.S. Banks like we did back then. Europe is experiencing some issues that we are monitoring closely. WHEN Greece defaults we will see how the system handles it and decide if the system is going to roll over again or not. It is our guess that when Greece defaults the European monetary authorities will “TARP” their banks like the U.S. did and THIS STOCK market correction will end. By injecting capital into the banks you end the contagion fear and confidence will return to the system. Until they do that we will have a very nervous market that we are monitoring closely.

Did you know that the S+P 500 will report record earnings this year? If you didn’t know that don’t feel bad because nobody else talks about it either. Why talk about good news when you can focus on Greece. Here is a quick rundown on how some of our companies are doing. We have been saying for awhile that Berkshire Hathaway’s stock is ridiculously cheap. This week Warren agreed with us and decided to buy back his stock for the first time since the market low of 2000. Earnings on his non insurance business are up 10% year over year and I look for that number to accelerate. Bgcp’s earnings are up 34% year over year while paying a dividend over 8%. Level3’s earnings are up 12% year over year. Wal-Marts earnings are up 6% year over year. Wells Fargo’s earnings are up 30% year over year. Maxwell Technologies has a growth of 53% in earnings year over year. American Public’s earnings are up 28% from last year. Rentrak‘s earnings are up about 50%. Cintas’s earnings are up 12% and we do have one down report, Corning’s earnings were down 7% year over year. We have more stocks we could put in here but you get the point, earnings are good but the stock prices don’t reflect it. This type of thing only occurs when the public is bummed out and we have some data on that to show you.

The chart above shows money going into and out of U.S. equity funds. As you can see from the chart above investors have surrendered and given up on stocks. In the last 4 years they have pulled out over half a trillion dollars from the stock market. You can hardly blame them with all of the volatility we have had to deal with lately. If I could find an 8% treasury bill right now I might give up too but I can’t find one I like. Yes, Brazil’s rates are above 10% but we don’t like what they are doing over there right now and rates in Australia and Canada aren’t high enough to entice us to go there. As you can tell from the chart the public was starting to stick their toe back in the water in 2010 until the flash crash sent them for the exits and they haven’t come back since (the stock inflows in January 2011 were Ira related). John Templeton use to say “If you have to wait in a long line to buy something you aren’t getting a bargain”. I can assure you there is no line to buy stocks right now which is why we continue to buy them. I am convinced when investors hate something we are near the lows. Can the market go lower? Sure. Will it stay there? We don’t think so. I have been telling Brandon and Kelly lately that someday this business will be fun again, Governments don’t always talk about defaults every day, U.S. politicians weren’t always this dumb(that might be a stretch), that earnings for companies really did matter and there really was something called inflation when I grew up. What will be the catalyst to change the mood investors are in?

We think a resolution in Europe is the start. When Greece defaults the banks of Europe are going to need more capital. If the banks get “Tarp” money from their governments the markets will take this very positively. We also continue to feel that any unrest in China is a sign that they can’t keep manipulating their currency rate to help their exporters while not paying their workers enough to eat. It appears we are heading for a conflict there and we will take any problems in China as a sign that changes in their export policies will occur. There is also a currency manipulation bill in Congress that bears watching coming up in October. This bill is aimed directly at China. The raising of the Chinese currency will help our economy bring back jobs to the USA. We also feel that the elections will help the national mood. Without being too political right now everybody is depressed and at least after November of next year only half of the country will be depressed. We also think housing has bottomed which is still the most unpopular thought we have right now. If we are right, that will lower the unemployment lines and make GDP better.

We are going to have the Christmas party this year on December 15th at Highland Springs. The time is from 6 to 8. We will be sending you an invite after Thanksgiving but we wanted to give you a heads up of when it is.

Finally this paragraph is a sales pitch so you might want to skip it. We think the market is cheap and we are looking for more investors who might want to invest with us. I know it’s counter intuitive to ask for money and referrals after we just put in a crummy quarter for you but we think the values here are great and we are willing to bet accordingly. Thank you for your support.

Sincerely

Mark Brueggemann IAR Kelly Smith IAR Brandon Robinson IAR

P.S. Level3 is going to do a 15 for 1 reverse split on its stock October 19th. What this mean to you is that if you have 1500 shares priced at $1.40 which is worth $2100 dollars today you will now have 100 shares priced at $21 dollars for the same value of $2100. Level3 will also now be listed on the New York stock exchange. The company hopes these changes will improve the trading of their stock. Some institutions cannot own or buy a stock priced below $5 and now they will be able to buy Level3 if they so choose. We view this event as a mild positive.