Trend Management’s Year End Report 2017

2017 was a very good one for stocks. The strength in the stock market incurred little volatility. This is unusual. The stock market had the least number of pullbacks in the S&P 500 in twenty years, leading investors into a false sense of security, if not complacency. A more volatile market in 2018 is not an if, but a predictable when we’ll again experience a market correction.

The period from 1996 to 2000 is our blueprint for what might happen in this cycle. Peaceful, profitable 1995-1996 was very similar to 2016-2017. During both periods, the Federal Reserve raised interest rates, yet the stock market continued to go up. Alan Greenspan, then-chairman of the Federal Reserve, gave a speech on December 5th, , 1996, calling the stock market “irrationally exuberant.”

At the time, the S&P 500 was at 750. Under our current valuation system, we calculate the stock market in 1996 was about 15% overvalued. (We think it is similarly overvalued today.) Four years after Greenspan’s speech, the S&P 500 was at 1500, for a gain of 100%. Between 1996 and 2000, there were three corrections of 10% or more. Contrary to Mr. Greenspan’s fears, the markets remained exuberant for another four years.

No one, including us, knows how excited investors will be during any bull market, or can pinpoint the market’s exact top. However, we think there are seven signs in most bull markets that indicate when the party is getting out of control, the market is topping out, and more caution is warranted. In 1999-2000, one indicator after another flared red, and eventually, the market went bad. Fast-forward to today, and no indicators have yet turned negative. If they do, the market could still go up. The market could also go down, before any indicators flare red. Will that cause us to sell all our stocks? No, but it would signal time for caution.

The money the world’s central bankers have printed over the past decade is going to go somewhere, and it’s our job to figure out where that is. Stocks will continue to be the main investment we make for our clients, but not the only one. We want to remind you that being cautious doesn’t always mean be in cash.

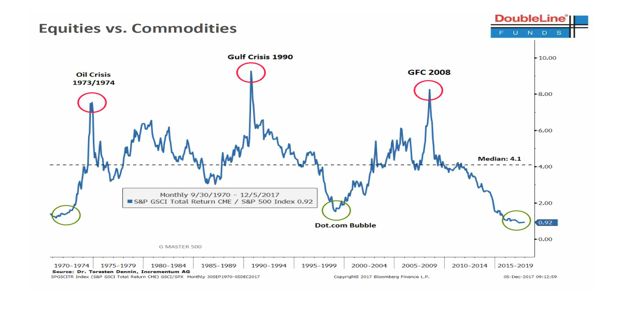

We have written previously about why we have gradually invested in commodities. The chart above does a great job of illustrating how cheap commodities are, versus stocks. We are close to setting record lows on this index. If a chart is worth a thousand words, this one will save us a lot of typing. What the chart doesn’t convey is when commodities will start to out-perform stocks (the line moves back up). It also doesn’t note whether stocks go up, but commodities rise more, or stocks tank and commodities fall less. It does indicate there is value in owning stuff, versus stocks. It is our opinion, before this bull market in stocks is over, stuff will have a good, upside run, and we hope to profit from it. We are actively looking for ways to invest more money in this area. Investments to date have worked out, and we would like to own more.

We started rolling out the growth stock system this quarter. We now own Skyworks Solutions, Data I/O, and in a few accounts, Profire Energy. Profire sells burner management systems for the oil and gas industry, and the float is very small. We have been cautious on how much we can buy, without disturbing the price of the stock. Profire is also working on a system to lower the cost to transport oil and gas in pipelines.

Skyworks gets 40% of its revenue from Apple, and we think this revenue stream is secure for now. What is exciting for Skyworks’ future is it appears to be a prime beneficiary of the move to 5G and the Internet of things (IOT). 5G stands for fifth generation wireless connectivity for mobile devices. What’s exciting about 5G is its wireless capacity to replace cable TV. Verizon, AT&T, Sprint, and T-Mobile will also roll out this service in late 2018. This is the first serious competition to the cable bundle we have seen. 5G will not only benefit Skyworks, but also CenturyLink. Competition is coming to the last mile and we think it’s a good thing for our accounts.

Data I/O is a particularly interesting stock. It has a market cap of $100 million. It initiated a system to make semiconductors more secure from data hackers. It also develops hack-resistant chips for self-driving cars. We have researched the system and think it has a chance to be a big winner, if Data I/O executes. It has announced customer wins with EBV Elecktronik, Maxim, and Renesas. This quarter, its revenue growth was 45% over the previous quarter, last year. Let’s hope that trend continues.

CenturyLink pays a dividend of $2.16. At today’s price of $17.33, it represents a dividend yield of 12.46%. We think that yield is secure. We understand, when a stock has this high a dividend yield, the market is saying the dividend is going to be cut. We don’t agree. One of us is wrong. We hope it isn’t us. In the last month, seven CenturyLink insiders bought stock in the open market. We hope they are right.

We continue to like BGC Partners. Sometime this year, it will spin-off to shareholders its real estate division, Newmark Group. When that occurs, the price of BGC’s stock will decline to reflect the spin-off. We have not decided whether to keep the Newmark stock, but will continue to hold our BGC stock. At today’s price of $15.18, BGC yields 4.8%. We think that yield will continue after the spin-off. We will continue to update you on this in our next reports.

There is new tax law in 2018. Here is a brief take of what we see in this legislation. On the corporate side, the winners appear to be companies that spend a lot of money on capital expenditures (capex). These companies will now be able to write off 100% of their capex in the year they spend the money. This is a huge incentive for beneficiaries, primarily steel and telecom, to spend more money to juice the economy.

The potential losers are companies that gamed the tax system to lower their U.S. taxes on their intellectual property rights. These companies are mostly the large technology stocks, like Google, Apple, and Microsoft. They placed their intellectual property in low tax havens like Ireland, and the Caribbean. We have read that the tax savings on this strategy was around 10% to 13%. We think that loophole has been closed, and it will affect a lot of high-tech companies.

We think the stock market has rallied this quarter on the perception the new tax law will spur record earnings. Bank of America has issued a report projecting a 10% boost to its earnings. Should that occur, it will help close the gap between today’s overvalued market and its historical mean. The tax law will give stocks a short-term earnings increase, when first quarter stocks report at the new rate. We will analyze these reports very carefully to identify what other things are in the legislation we aren’t yet aware of today.

We won’t make investments in your account based on what may or may not happen as a result of new tax legislation. Our continued focus is on the sustainability of our companies’ businesses, and if they execute on their business plans.

We hope you had a happy 2017. We will do our best to make 2018, a profitable year. If you have any questions about this letter, or about your account, please give us a call (417-882-5746)

Sincerely,

Mark Brueggemann IAR Kelly Smith IAR Brandon Robinson IAR